Latin America Carbon Trading Market Research Report: Forecast (2024-2030)

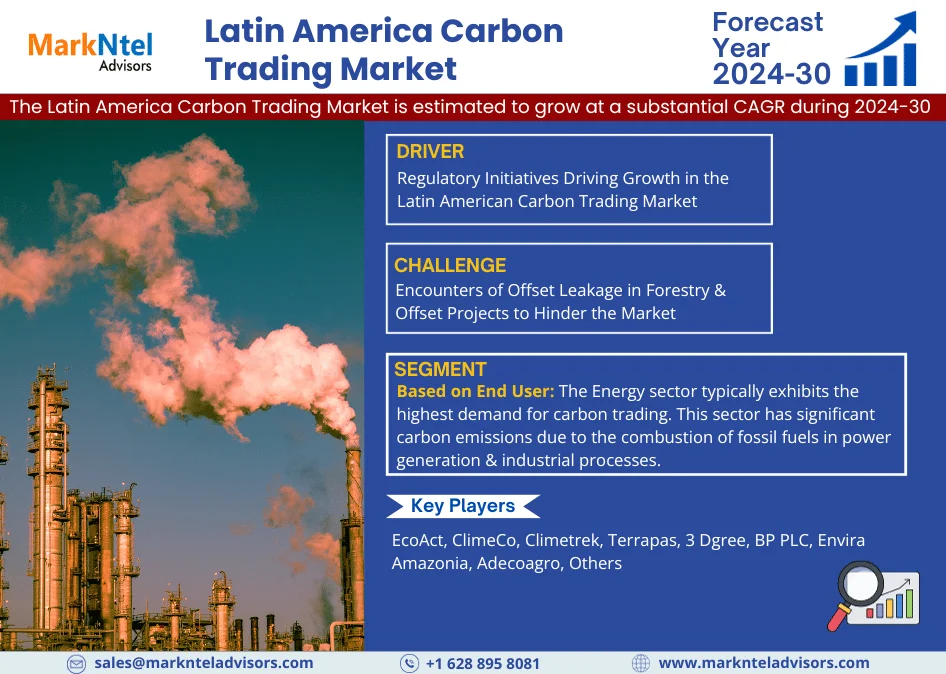

The Latin America Carbon Trading Market is estimated to grow at a substantial CAGR during the forecast period, i.e., 2024-30. The region is witnessing a continuous increase in the demand for carbon trading, primarily due to rising levels of greenhouse gas (GHG) emissions, contributing to a global temperature increase & significant environmental impacts. Countries like Brazil, Argentina, and others are actively transitioning towards low-carbon economy strategies, further fueling the demand & supply of carbon credits in the market. In response, numerous carbon-emitting companies are making investments in carbon trading, purchasing carbon credits to reduce & mitigate their environmental emissions.

Request for a sample of this research report at (Use Corporate Mail Id for Quick Response): https://www.marknteladvisors.com/query/request-sample/defense-secured-communication-market.html

Market Dynamics

Latin America Carbon Trading Market Challenge – Encounters of Offset Leakage in Forestry & Offset Projects to Hinder the Market

Forestry projects are susceptible to a phenomenon known as offset leakage, which presents challenges in accurately measuring and quantifying this phenomenon in both forestry and other offset projects. The quantification of leakage varies across different protocols, contributing to a lack of consensus on the validity of these projects. As a consequence, these projects have often resulted in a mere relocation of emissions, failing to achieve a net reduction in carbon emissions, thus impeding the Latin America Carbon Trading Market.

Leading Companies in Latin America Carbon Trading Market:

EcoAct, ClimeCo, Climetrek, Terrapas, 3 Dgree, BP PLC, Envira Amazonia, Adecoagro, Others

Segmentation of the Industry

The Latin America Carbon Trading Market is highly fragmented and bifurcates into the following segmentations:

By Source

-Forest

-Agriculture

-Carbon Capture and Storage

-Others

By Platform

-Compliance

-Voluntary

By System

-Cap & Trade

-Baseline & Credit

By End-User

– Oil & Gas

– Energy

– Utility

– Chemical

-Automotive

-Others

- The Energy sector typically exhibits the highest demand for carbon trading.

Browse complete Latin America Carbon Trading Market report details with table of contents and list of figures click here – https://www.marknteladvisors.com/research-library/latin-america-carbon-trading-market.html

Regional Landscape

On the geographical front, the Latin America Carbon Trading Market expands across the following:

By Country

-Brazil

-Argentina

-Mexico

-Rest of Latin America

- Brazil’s vast and diverse economy encompasses agriculture, manufacturing, energy, and transportation, all of which contribute substantially to greenhouse gas emissions.

About MarkNtel Advisors

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

To find out more, visit MarkNtelAdvisors or follow us on Twitter, LinkedIn and Facebook.

Reach us:

Call: +1 628 895 8081, +91 120 4278433

Email: sales@marknteladvisors.com

Visit to know more: www.marknteladvisors.com